Tuesday, December 18, 2012

Robert Kiyosaki: Retire Young Retire Rich

This book is all about leveraging. The power of leveraging. Your mind is one of the most powerful form of leverage in the world and what you think and believe will influence how you make your decisions and take action. Laws of attraction.

How to leverage your mind, how to leverage your plans, how to leverage your actions and the leverage from taking that first step.

The three main assets that you can employ to enable you to retire young and retire rich are:

1. Real estate

2. Paper assets/stocks/shares

3. Businesses

Most of his books have repetitious sections and again, constantly spruik his own cash flow game and various other products. For the sake of this book analysis, I read everything.

Leveraging your mind

* Learn investment terminologies and words. The more financial words you learn, the greater your ability to invest and take advantage of various investments

* How did Kiyosaki get wealthy and successful? He writes that it was by increasing his:

a) Business skills

b) Money management skills

c) Investment skills

* Words that will work against you:

a) "But we don't have any money."

b) "I can't do that."

c) "I'll think about it next year, or once Kim and I get settled."

d) "You don't understand our situation."

e) "I need more time."

f) "Maybe someday when I have the money I'll begin to invest."

g) "Do you know how busy I am? I don't have the time to to learn to invest."

If you haven't got any funds to invest, then you can invest in your financial knowledge by taking the time to learn about investing in property, stocks and businesses. It costs nothing to acquire financial knowledge now that you can use the internet and you can always go the old school way and borrow books from the library. It's free to attend auctions, free to ask questions, free to attend open houses and free to analyse investment deals even if you haven't got the funds to invest. By the time you DO have some funds to invest, you will already be an investment pro to some extent because of the time that you've spent investing in your financial knowledge.

* "...the middle class and the poor fall behind the rich is because they use the financial power of bad debt to fall behind in life. The rich use the financial power of good debt to propel them ahead."

* Kiyosaki believes that his wealth resulted from the three asset classes mentioned (real estate, paper assets and business) and these were magnified by leveraging OPM (other people's money) and OPT (other people's time).

* Kiyosaki doesn't believe in someone being lucky simply by being at the right place at the right time. Luck happens only when you're "educated, experienced, ready and prepared to take advantage of the opportunity when the opportunity presented itself".

* The million dollar question that you can ask yourself. If you can answer this question, then you can create your own leverage into wealth: "How can I do what I do for more people with less work and for a better price?"

* "A person who thinks investing is risky will often find all the reality they want to substantiate that reality." Change your reality and your views in life by choosing to say, "How can I afford that piece of beachfront property?" instead of saying,"I can't afford it."

* Three form of income is mentioned:

a) Earned income - from your personal labour, your pay cheque, when you get pay rises, bonuses, overtime and commissions etc

b) Portfolio income - from your stock portfolio such as stocks, bonds, mutual/managed funds

c) Passive income- from real estate, royalties, patents and intellectual properties

* Earned income is disliked by Kiyosaki's 'rich dad' due to various reasons:

1. Highest taxed income with the fewest control over how much tax you pay and when you pay your taxes

2. You have to personally work for it using your valuable time

3. There's very little leverage in earned income and the primary way to increase earned income is by working harder

4. There is often no residual value for your work. If you don't work, you don't get paid.

* Again, Kiyosaki repeats himself from previous books:

a) Employee -> Earns, taxed, spends what is left

b) Business owner -> Earns, spends, pays tax on what is left

I'll use a simple example to illustrate this concept for you:

a) Employee with 30% tax -> Earns $100, is taxed $30, spends $20, is left with $50 in the pocket

b) Business with 30% tax-> Earns $100, spends $20, is taxed 30% on $80, is left with $56 in the pocket

* "The idea of working all your life, saving , and putting money into a retirement account is a very slow plan. It is a good and sensible plan for 90 percent of the people. But it is not a plan for someone who wants to retire young and retire rich. If you want to retire young and retire rich, you need to have a plan that is far faster than the plans of most people."

* "...you need to invest in what is going to happen, rather than what has already happened...If you want to see the future, you need to see it through younger eyes."

* "Over the years, we have attended many investment seminars, seminars on marketing, sales, systems development, handling employees and of course investing...I meet authors who did well in school as writers but their books do not sell as many as mine do. When I suggest to them that they attend direct marketing courses, or sales training courses, or copy writing classes, many get very indignant. As I said in Rich Dad Poor Dad, I am a best-selling author not a best-writing author."

* Calculate your wealth ratio. The goal is to have your passive and portfolio income exceed your total expenses so that even if you quit your 'earned income' job, you can still maintain your lifestyle. Once the ratio is 1 or higher, it's a choice whether you wish to quite the 'rat race' or not:

Wealth Ratio = Passive income + Portfolio income

Total expenses

Example: $600 passive + $200 portfolio = 0.2 wealth ratio

$4000 total expenses

* "When I think of the millions of people who are betting their financial future and their financial security on a stock market I cringe. Millions of people are worried about their financial future as the number of layoffs increase and the market continues to fluctuate....there are stories of how retirees have lost most of their retirement savings to investment advisers and insurance salespeople they trusted..."

* "Your life will change forever once you know the difference between saving money and making money."

* "The most life destroying word of all is the word tomorrow...the poor, the unsuccessful, the unhappy and the unhealthy are the ones who use the word tomorrow the most. These people will often say, 'I'll start investing tomorrow,' or 'I'll start my diet and exercise tomorrow.'"

* If you see an opportunity arise but were unable to take advantage of it, then "you are at the boundaries of your context, what you think is possible for yourself, and your content, which is the accumulated knowledge via which you handle problems and challenges..."

* Kiyosaki spends pages and pages writing about your reality, how people don't realise that their reality is only limited by their mind. If you don't expand your reality then you will never see the answers to your problems because you are trying to solve your current problems with your existing knowledge and experience: "Most people try and solve their financial problems with what they know, rather than expand what they know so they can solve a bigger problem. Rather than taking on bigger financial challenges, most people wrestle all their lives with financial problems they feel comfortable with."

* In the book, 'Who took my money', you read about the E and S side of the quadrant and the B and I side of the quadrant. The goal is to move to the B-I side of the quadrant because income on the E-S side is limited whereas the earning potential from the B-I side is unlimited: "The trouble with selling your labour is that there is only so much you can do. If you learn to acquire or build assets to generate money, you can slowly but surely increase your income...your labour has no long term residual value. If you buy a rental property and you profitably rent it out, the labour you used to acquire that rental property can be rewarded over and over again, for years."

* "If you work slowly acquiring assets your income potential is infinite and that income can be passed on for generations to come. Your job or profession is not something you can pass on in your will to your children."

* "It is not your boss's job to make you rich. Your boss's job is to pay you for what you do, and it is your job to make yourself rich at home and in your spare time."

* "The moment you sincerely build a business or invest to increase your service to more people, you have forever increased your chances of becoming extremely wealthy and retiring young and retiring rich."

Leverage of habits that will make you rich

1. Hire a bookkeeper - having a bookkeeper keep your income, expenses, assets and liabilities in line so that you can keep professional records, have an unemotionally attached third party review your financial challenges so that you can make corrections via a monthly review of your financial situation

2. Create a winning team- the B+I quadrants are 'team sports' requiring team members such as your banker, accountant, attorney, stockbroker, real estate broker, insurance broker etc

3. Constantly expand your context and your content

4. Keep growing up- doing things differently as we grow older instead of doing the same old thing day in day out.

5. Be willing to fail more- by being willing to try new things and make mistakes

6. Listen to yourself- pay attention to what you are saying to yourself and focus on what you want from life and in your life

* "Kim(his wife) and I did not keep our money in a retirement account in order to retire young. We knew that we had to keep our money working, working hard to acquire more and more assets. Once our money acquired an asset, that money was soon reemployed to go out and get us another asset. The strategy we used to keep our money moving and acquiring more and more assets is a strategy that almost everyone can use."

* Comparing the stock market to the real estate market:

a) The stock market is simply buy or sell

b) The real estate market is negotiable- terms are negotiable, can lower or raise the price, can reduce expenses, can improve the value of the property by renovating such as painting, adding extra bedrooms, selling off extra land etc

* It does not take money to make money - Kiyosaki recommends people engage in option trading. I don't think I fully agree with his recommendation here because although you can write naked call and put options for a minor fee, if the naked options are being exercised by the holders of your put and call options, then you better HAVE the money to be able to buy the stocks off the put option holders or have the funds to buy the shares so that your call option holders can buy the stocks off you. So unless you wish to get into financial difficulty, it DOES take money to make money if you wish to pursue this particular strategy that Kiyosaki is proposing. Anyone trying to pursue this options trading strategy needs to ensure that they have backup funds that can be used to buy stocks off naked put option holders trying to exercise the put option that you sold them and similarly, have the funds to buy stocks that can be resold if holders of naked call options exercise their options.

I have to agree with Kiyosaki with respect to the statement that it doesn't take money to make money. You DON'T have to have money to make money. You can create money in so many ways even if you have zilch. If you are creative or have a great idea, you can sell your ideas. You have talent. You just need to capitalise on your talents, knowledge and abilities. You can create an intellectual property, you can create a blog (like this) from scratch for free and generate advertisement income from Google Adwords and from advertisers wishing to advertise with your blog/website. I created this site from scratch and it didn't cost me a single cent and it's been generating income for me. That's just one example. Obviously the more money you have, the easier it is to buy and create investments and the faster you make more money.

But work with what you've got. If you've got nothing, you can create something from nothing. The sky really is your limit. There is over 6 billion people on this planet and what is stopping you from generating a chunk of revenue from that population?

What would you do if there was no risk and it required no money to become rich?

Kiyosaki challenges us to think about what we would do if there was no risk and no money required to become rich. What type of business or investment or hobby would you start? What trade would you be in? Would you retire? Do you think that type of world exists? If you think that world is non existent, do you think you are destroying yourself by limiting your creativity?

In closing, Kiyosaki writes that "Leverage is power. Leverage is found inside of us, all around us, and invented by us. With each new invention, inventions such as the automobile, airplane, telephone, television, world wide web, a new form of leverage is invented. With each new form of leverage, new millionaires and billionaires are created because they used the leverage, not ruined or abused the new leverage. So always remember that the power of leverage can be used, abused or feared. How you choose to use the power of leverage is up to you and only you."

Saturday, December 15, 2012

Robert Kiyosaki: Who Took My Money?

Robert Kiyosaki's book(co-authored with Sharon L. Lechter), 'Who Took My Money?' on "Why slow investors lose and fast money wins" is an interesting read. If you've never heard of Kiyosaki, then you've been living under a rock. He's been on the New York Times Bestseller list multiple times with multiple books.

Although 'Rich Dad Poor Dad' is his most famous book, it's not a favourite of mine. His later books are much better because he becomes a more experienced investor with a better advisory team when he has more money to invest and it's evident in the later books compared to his earlier work. Kiyosaki's book can be annoying to read sometimes because he keeps plugging his own products and boardgame, almost in every single chapter :/

Are Mutual Funds and Managed Funds evil?

Kiyosaki thoroughly dislikes Mutual Funds (for Australian readers, Mutual Funds=Managed Funds, 401(k)=Retirement Funds). He's always denouncing them and telling readers to steer clear of them. I'm not a huge fan of managed funds either. Some are decent (like the index funds with low fees) but the majority has high fees, does not outperform the index (eg All Ords, ASX200) and will charge you fees even if they are losing money hands over fist.

I'm going to highlight the bits that I found interesting or may be of interest to anyone else. 'Who Took My Money'(WTMM) was first published in May 2004, prior to the GFC and mainly reflects on the dotcom sharemarket bust. Ironically, his book is timelessly relevant in light of the GFC crisis that rocked the world in 2008.

WTMM is structured into two sections: "What Should I Invest In?" and "Ask An Investor".

What Should You Invest In?

Kiyosaki doesn't like diversification in simply the stock market. He recommends 'integrating' and using the powers of the following 'financial forces':

1. Business

2. Real estate

3. Paper assets (shares/stocks)

4. Your banker's money (via leveraging/gearing/mortgage loans/margin loans)

5. Tax laws (via depreciation and the ability to deduct expenses prior to paying tax on profits)

6. Corporate laws (via business entity, copyrights, patents etc)

Whereby, the more you can mix and match those particular 'forces', the more you can accelerate your wealth and returns to create 'financial synergy'.

He refers to life as 'The Game of Money' because we work for approximately 40 years. When you're 25-35yo, you're in the first quarter, 35-45 is second quarter, 45-55 is third quarter and 55-65 is the fourth quarter. After 65, you're in overtime and if you're disabled or have some health impediment, then you're 'out of time'.

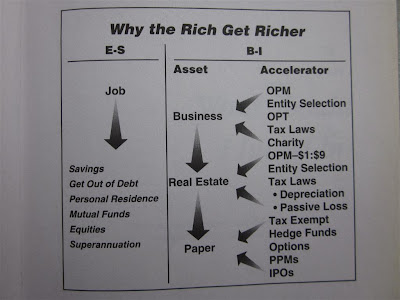

Kiyosaki refers to a cash flow quadrant whereby he recommends moving from the 'employee' and 'self employed' side to the 'business owner' and 'investor' side of the quadrants will accelerate your returns. See below:

Employees and self employed individuals will only earn income whilst their personal labour is involved. If you don't work, you don't earn. Simple. On the business owner and investor side, if you don't work, your business and your investments will still generate passive income for you.

The reason why B-I are will help you get richer faster is due to reasons such as utilising OPM(other people's money), choice of operating entity, ability to depreciate your assets against your returns (he refers to depreciation as 'phantom income') and the ability to leverage. Just as the financial institutions use leveraging(on bank deposits) to magnify their returns, you can also use leveraging(from bank/mortgage loans) to magnify your own returns. Savers and depositors earn peanuts on their savings.

The most important aspect of the B-I side which I would also like to emphasise is that you can deduct your expenses against your income prior to paying tax as a business owner and investor. Unfortunately for employees, usually you pay tax first prior to being able to deduct your expenses.

Kiyosaki rather dislikes answering the question, "I have $10k, what should I invest in?". It's a difficult and complex question to answer. Firstly, it depends on your own scenario, how old you are, where you're at in life, what existing debts you have already and where you're at in terms of financial knowledge and experience. If you don't know what to do with your $10k, then the best thing you should do is stash it in a high interest savings account. Go read about investing and then you will have a better idea of what to do with it. Otherwise, you will eventually get fleeced.

He writes that simply putting all your savings into a 'mutual fund/managed fund', dollar cost averaging by monthly contributions, crossing your fingers and praying that the stock market goes up is akin to gambling. There are no guarantees that you won't lose money, there are no insurance company that will insure your stock portfolio against losses. You can insure your stock portfolio but you will need to employ put and call options which are techniques that most average and newbie investors are unable to employ.

He contrasts this against buying investment properties. Insurance companies will insure investment properties because it's a more stable investment but they won't insure your stock portfolio. Using these two examples, he illustrates that the stock market IS riskier than the property market.

"One of the reasons so many investors lose so much money is because they pay $10 a month into a fund for forty years and do not know if it will be there forty years from now."

Maybe Kiyosaki was on the foreclosure ball already back in 2004 when he wrote that, "Today in Phoenix, Arizona, the fastest growing major market in America, foreclosures are up. Many people are losing their homes. Investors are bailing out of properites that they paid too much for."

Unfortunately he was wrong thus far on the Australian property market, "In Australia, interest rates are on the rise again, which will mean the greater fools of the property market will be led to slaughter." Property prices have risen significantly since 2004.

Building pipelines

I once read a quote from Napoleon about investing. He said that investing is like planting trees(or was it fruit trees?). It takes many years, but after several decades, you will have a forest to protect and feed you. I like thinking about investing as planting young fruit trees. The more fruit trees planted and the earlier you plant them, the more fruit you will get as they mature over the years and you will beable to enjoy a whole forest and orchard of trees.

Kiyosaki compares investing to building pipelines. Over the years, you wish to expand the diameter of your pipelines. The goal is to "simply build the pipelines and continuously expand the diameter of the pipe" which is a metafore for increasing the amount of passive income and return that flows from your investment. When you first start, it's a drip and over time as you expand your business and or investments, it becomes a heavier flow of passive income.

This post is becoming insanely long so I'll just quote directly from the book without any of my own personal reflections:

* "one of the most important assets an investor needs to manage is their flow of information. One of the reasons many millions of investors lost trillions of dollars is because they received financial information that was of poor quality, late, often biased, and sometimes dishonest."

* "Waiting for the long term...millions of investors, even while losing a lot of money in the stock market, are still waiting for the market and the price of their shares to come back up. That is a waste of time. Although the market will someday be back, the market that they lost their money in is gone...instead of investing for the long term, they are waiting for the long term..."

* "The professional investor follows the following formula:

1. Invest money into an asset

2. Get the original investment money back

3. But keep control of the original asset

4. Move the money into a new asset

5. Get the investment money back

6. Repeat the process ...this process is called the velocity of money...most investors do not realise they too can expand their own money supply and thereby expand their earning power"

* "Consider control and how it differs among the different type of asset classes...

Owning your own business - You are in control

Owning real estate - You are in control

401(k)s /retirement funds - Who is in control?

Mutual funds/managed funds - Who is in control?

Equities/stocks - Who is in control?

... The individual companies have presidents and board of directors who have control over the operation of the underlying business...professional investors want CONTROL over their assets and their cash flow." The ability to control means you can determine how to reduce expenses, how to increase income, when to pay tax (ie when to sell and trigger CGT tax) and your leveraging ability.

* "Many people just turn their money over to total strangers and wonder why they get such poor returns. Or many people seem to think that it should be easy to find a great investment...The fact is, it's easy to find bad investments. The world is filled with people offering you bad investments to invest in. If you want your money to work hard for you, you cannot afford to be lazy."

* "Four green houses...one red hotel...the purpose of business is to make life simpler, not harder. The businesses that make life the easiest are the businesses that make the most money." He employs examples such as cars, phones, supermarket, electric companies etc

* "You should learn to take things that are difficult and make them simple. If you will focus on that, making life easier for people, you will become a very rich person. The more people you help in making life easier, the richer you will become."

* "The power of power investing...it is investing using all three asset classes(business, real estate and paper assets), reinvesting cash flow, leveraged with OPM and accelerated by tax incentives...power investing requires that the investor invest in two, and preferably three, asset classes."

* "...why then do so many more people invest in paper assets and give up so much control? ...the answer...found in the word easy. For millions of people, it is easier to turn over control of their money than to learn how to drive their money. That is why millions of investors have their portfolios filled with mutual funds without any idea of who is driving the fund..."

* Kiyosaki likes paper assets primarily due to their liquidity rather than their long term value. I agree absolutely.

* An employee's cash flow pattern: EARN-->PAY TAX-->THEN SPEND

* A business owner or investor cash flow pattern: EARN-->SPEND--THEN PAY TAX

* "...the five considerations for each investment and how the investment fits into your overall investing strategy:

1. Earn/create- how will it generate cash flow for you?

2. Manage- how will you manage this investment?

3. Leverage- how much leverage will the investment provide, or can you get?

4. Protect- how should you hold the investment, maximise its profitability and protect it from potential creditors?

5. Exit- how will you get your original investment money back?"

That last quote from the book is imo, one of the MOST important part of the investing process. Answering those five points prior to investing will mean you've looked at all the aspects of the cash flow, the potential benefits, protecting your asset and finally, being able to extract your capital so that you can invest in additional assets.

Investing for cash flow is a VERY important concept. If you only invest for capital gains and employ negative gearing as your dominant investment strategy, eventually you will hit a debt servicing capacity wall and be unable to service further investment leveraging due to poor cash flow.

It's been a long time since I've written a book review and now I remember why I don't post book reviews often lol. PHEW!! It has been over two years since I've published material regarding personal finance books. The last one I wrote two years ago, 'Top 10 Books on Wealth' is STILL relevant because they're classic books. You should read that post if you like reading personal financial management books.

Friday, April 20, 2012

Financial Samurai's Financial Freedom Fund

Warning that this is a super long post in response and reflection to the Financial Samurai's super long post about his passive income allocation.

The Financial Freedom Fund is commonly used to refer to savings and assets that have grown as such that the returns (income) from them are self sustaining and you can survive on the passive income without having to work. That is, you can retire and become a self funded retiree if you wish to. The premises underlying a Freedom Fund is building passive, multiple income streams to fund your 'retirement' and 'freedom'.

The Financial Samurai and His Freedom Fund

The Financial Samurai (FS) Sam, has a very interesting post about his Freedom Fund, 'Achieving Financial Freedom One Slice At A Time'. His investment methodology is logical and methodical which reasonates with me. More importantly, when it relates to investment or financial advice, I like reading material from authors and bloggers who practice what they preach.

The FS recently posted about his Freedom Fund and retirement and it's a VERY long article chocked full of numbers if you like that sort of stuff. From the personal details he's divulged in his posts, he's probably in his late 30s to early 40s, so anyone in their 20s, 30s or 40s should easily relate. I like his investment style and the proportions of his diversification across the asset classes (CDs/Stocks/Property/RE funds etc).

My thoughts are that he has a balanced(agressive and defensive) investment portfolio/Freedom Fund which is what anyone in their 20s/30s/40s should be looking at. Folks in their 50s/60s and beyond need more defensive and less volatile assets as they get older.

My own investments are structured similarly to how FS has structured his, albeit I have a LOT less in my funds than he has lol. From reading FS blog for about 2 or 3 years, he probably has $3million plus in assets and capital. He only provided his monthly passive income- I'll work backwards to arrive at his approximate capitalisation amount:

1.CD Interest Income $2800/month, 33600pa and at an average return of 4% (see his blog)= $840k capital

2.Dividend Income $1200/month, 14400pa and at an average yield of 5% (that's an avg yield for me on the pessimistic side since he didn't provide a yield)= $288k capital

3.Rental Property Income $2500/month= yield not mentioned so can't work out the capital on that

4.Private Equity Venture = $100k capital (he mentions 6 figures so that's on the pessimistic end)

5.Real Estate Fund = $110k capital (factoring in $50k returning 120%)

Total Capital $1,338,000

PLUS

San Francisco principal place of residence

Investment Property

401K

Blogging income/savings from FS Blog and Yakezie

That's pretty impressive, very well diversified and is a well balanced portfolio from the extent that he has divulged and broken down for the public to see. A wise man indeed.

How Much Do You Need In Your Freedom Fund?

How much you need in your Freedom Fund = Retirement Fund needs. It's a topic I haven't really covered comprehensively because retirement is decades and decades away, plus my own retirement fund returns SUCK majorly and I can't wait to one day run my own SMSF/retirement funds. Need $200k plus in there for sufficient critical mass to justify the fees of running an SMSF.

There are heaps of calculators on the net that will crunch those numbers for you. I'm not going to do it because there are way too many variables involved, tons of rule-of-thumbs theory and for me not to mislead you, I'd have to write a book. Roughly, you'll need to think about:

*What lifestyle you like (Eg: Comfortable, dining out, some holidays per year)

*How much will it cost to fund that lifestyle (Eg: $1000 per week)

*What amount of capital or savings you'll need to save up and invest to generate that income to fund that lifestyle. (Eg: To fund the lifestyle examples above, if $1000 per week is generated from 5%pa bank interest, you'll need to save $1,040,000**)

The funds saved is commonly referred to as the 'Freedom Fund' in the blogosphere. It's freedom because it allows you to pursue your hobbies and interests and not be a slave to work. The essense of a Freedom Fund that is fully funded is that you don't have to work at all. You could bum around for the rest of your life doing nothing if you wish to because the passive income from your Freedom Fund sufficiently supports your lifestyle.

Many of us enjoy working but there are no guarantees that 35 years later we'll be keen on what we do now. Personally, I would never retire early if I had a choice- I love working and it ensures the mind is active and doesn't degenerate. Secondly- imagine being the only retired one in your friendship circle- who else would you hang out with if they're all busy working?

Recently, plenty of retirees find out that a) they haven't saved enough, b) a financial crisis can cause their portfolio to plummet and dividend income to be cut, c) unexpected costs and health problems can quickly erode income and capital, d) trying to find work when you're a lot older can be very difficult so while you're younger and can work- work as much as you can. Some were caught out by REITs that were 'frozen' and unable to pay out investors who wanted to exit the REIT because they had liquidity problems.

Anyway- this article isn't focused on retirees but the younger crowd who wishes to escape the daily grind, or build capital and investments that will allow them to create choices in their life. I have no-where near the amount that the $3million that Sam the Financial Samurai has. It will take me years to build $78,000-$117,600pa in passive income like the Samurai. You gotta start somewhere, right?!

That's it folks and have a great weekend yo!

______________________________________

** This is using flat interest with plenty of assumptions built in to avoid boring the general public to death. For those interested:

_ You need to factor in inflation (that the $1000 used in my example above, buys less and less every single year into the future)

_ 5% interest return can be too high (In the US the interest is 1% and even less. There is no guarantees that you can even earn 5% on your funds)

_ 5% return can be too modest (If you invest outside the bank into property or shares, you have the potential to earn significantly more than 5% pa)

_ Compounding is ignored (You can factor that into your returns if you're mathematically inclined)

_ Taxation is ignored (You can factor that into your returns if you're mathematically inclined)

Saturday, April 2, 2011

Update on progress bars and income

Sunday, February 20, 2011

Working multiple side jobs for extra income

I never had a problem with working two or three jobs, working six or seven days a week. If it had to be done, it had to be done. Afterall, my parents had worked seven days a week for over two decades with their business and never once complained about it. BUT... unlike a lot of personal finance bloggers, I never had any sort of crippling consumer debt to pay off. The extra income allowed me to buy stocks, go on extravagant holidays, buy investment assets and indulge in my various hobbies and interests.

Why are some people working multiple side jobs?

So do you think your life is tough?

On the weekend, while busy shopping, I chatted with a friend's hubby who updated me with the news that he's been working three jobs. A full time Monday to Friday office accounting role, Tuesday and Wednesday night doing restaurant and grocery store work and Sunday doing grocery store work. He's been trying to erode the mortgage and save some extra money for travelling. He's not the only one at that store doing three jobs. There was another guy that told me that he was a banker Monday to Friday, grocery night filler for 5 nights a week and during weekend daylight hours, worked in Dick Smith Electronics retails section.

If I thought they both worked hard, but then there was another guy that told me that he worked 7am to 4pm at a science lab and worked 5pm-10pm at the delicatessen every Monday to Friday and a full 8 hour shift on Sundays.

All three are working on average 70-90 hours a week holding down two or three jobs each. All driven by different factors - trying to pay the mortgage off early, trying to support parents who live overseas or trying to support the wife and two kids. Some people choose to whinge about not having enough income to buy the things they want and do the things they want, while some choose to work hard to earn that little bit extra so that they have the freedom and choice for their future.

A few years ago, when I raised the issue of multiple jobs and working 70-90 hour weeks, a friend of mine replied, "Why work harder? They should all be working smarter." True true, however, working multiple jobs can allow you to build your wealth or erode your debts much faster. If the idea of cutting back on current expenditure or luxuries in life is painful to you, then you could experiment with the option of working a second or third job while maintaining your current lifestyle. As long as you divert that extra income into saving/investing or paying off debt, then you shouldn't have to live so frugally nor feel guilty about it.

Ideas on how you can supplement your income with side jobs:

- Do contracting work on the side within your area of specialty, knowledge, experience or strengths. Examples: a programmer can write websites on the side, I.T consultants can do I.T contracting work on the side, web designers can do design work for weddings, parties, events on the side.

- Have a 'side hustle'. Examples: teaching music/guitar/piano/dancing, dog walking, baby sitting, gardening, mowing lawns, cleaning, blogging, selling items on Ebay/Etsy/Artfire, catering for birthdays, functions and parties if you have culinary skills, house sitting, coaching a sport team, tutoring a variety of subjects. There are plenty of pf blogs out there exploring the many ways in which you can create income on the side.

- Invest in assets to build passive income streams to replace your multiple jobs. This is my favourite option. If you're lazy then this should be your preferred option too. I label this as a side job because it's just as time consuming as a job. It requires a lot of hard work, effort and number crunching to find assets such as positive cash flow properties and good dividend paying stocks. Also to be diligent in ensuring that your funds are earning the highest market interest rates.

- Working in a part time side job. Examples: Retailing with clothes or food, waitressing, at stadiums or sport events. This one doesn't take advantage of your existing skills, knowledge or experience so will probably pay a lot less than contracting in a side job that uses your existing skills. Although it can add variety and allow you to meet other people from different walks of life.

LA Times and their money makeover disaster stories

You can read about the money makeovers at http://www.latimes.com/business/la-fi-money-makeover-furry-20110220,0,849848,full.story

A lot of the money makeover people featured could really do with second or third jobs to catch up and solve their financial problems. Although anyone with a lots of debts need good defense (cut spending) and good offense (increase income). Ever since Boston Gal started featuring these money makeover couples, I've been reading the makeovers.

Money makeovers involves cutting back on lavish expenditure, looking for how to increase income, how to budget, facing up to reality and how the disaster started to gain momentum and how to reverse that disastrous financial slide.

Would I ever consider working multiple jobs again?

Having time off to spend on personal interests and hobbies is a great way to balance life but if reality required me to hold down several jobs simultaneously, I wouldn't complain. The good thing about saving and investing to create passive income is to actually create choices and flexibility in life. At this point in time, if I lost my job, I could survive indefinitely without working.

It may not be surviving in luxury, but the basics would be covered by the passive income stream. That's what my ultimate goal is. To create choices for my future self and create options for pursuing further dreams, whether that be doing my own thing, or going down the philanthropic, volunteering route.

If you're stuck in this apex of life, holding down multiple jobs and wondering if it will ever end, you need to set some time aside to actually analyse your situation, form a budget and start finding out how you can force yourself to save. With those savings, you can learn to invest and build your investment portfolio whether that be from stocks, properties, bonds, CDs, deposits, interest or whatever. Your future self will thank your current self.

As a side note, thanks to those who have subscribed to my blog and those who have returned to read my new posts :) It's always nice to know that there are readers out there who return to read my new posts and that I'm not just writing for myself and for the sake of writing.

Friday, February 18, 2011

Peform monthly or fortnightly financial health checks for optimum results

The benefits are vast:

1) You can see what bills need to be paid, what you've paid, tally up any expenses if you track them and update accounting or financial management software if you use them

2) If you have a budget then you can see how your actual income and expenditure measures up against your budgeted ones

3) If you've got savings in high interest accounts, in term deposits or whatever, then you can have a quick hunt around to see if there are better rates on offer, negotiate for them with your existent bank or set up new accounts and transfer your funds into them

4) You can check to see if you've been meeting your liabilities and have been making payments against outstanding debts

5) If you've got funds in transactional accounts not earning any interest, then move them into a high interest account

6) If you've got debts or bills to pay, you can figure out how you're going to allocate your income to pay them, instead of waiting until the due date comes around and then panicking about how to pay them

Recently I just performed mine. It involves doing the following:

1) Checking the interest rates on my online saving accounts and ensuring that I'm receiving a competitive rate on my savings

2) Pay my bills, check for future bills that may be forthcoming, check my expenditure for the month, compare with previous month and if I can be bothered, compare with last years

3) Recurring bills such as insurances, checking to see other offers out there and requesting or changing to something more competitive if I can't get a better deal

3) Finding out the balance of my superannuation retirement funds, the balance of my HECS student debt, checking the market value of my portfolio of stocks (although the iphone Bloomberg app is fantastic for this - it will automatically update the prices whenever I'm on the WiFi)

4) Check the social events that are coming up and the gifts that I have to buy (birthdays, baby showers, special events) or give (most wedding gifts require money to be given as gift since most couples are already living together)

The results of my recent financial health check:

1) (good) Savings account were good, all up for 2011

2) (good) Interest and dividend incomes were good, also all up for 2011

3) (good) Stock portfolio was good (capital gains), up for 2011

4) (good) Superannuation retirement fund was good, also up for 2011

5) (good) Expenses for Jan/Feb 2011 was down from Jan/Feb 2010, which is good

6) (good) Investment loan liability balance for Feb 2011 is down from Feb 2010, which is good

7) (stable) My HECS student debt is pretty flat, have been contemplating making another lump sum payment in April. I had the plan to make an additional lump sum payment in April off my HECS / HELP debt to drop the balance to 30% (ie have 70% paid off)

8) (good) Net wealth balance is up comparing Feb 2010 versus Feb 2011, which is good

No Euro trip for 2011, bummer:

Unfortunately the Euro trip will have to be for 2012 instead. It turns out, I barely have any annual leave days left after burning through so many days in 2010. So as a result, the 2011 savings/funds will be utilised in four possible ways:

1) Lending some to my friend to buy the replacement car since it was my fault that we were in that region when the guy wrote off the car and the insurance payout is insufficient for buying a replacement

2) Spending some on a snow trip somewhere, either Australia or New Zealand

3) Buying the investment property or

4) Doing nothing and buying some(all) toys on my wish list

Note on Jan/Feb 2010 vs Jan/Feb 2011 - I had a lot of one off expenditures in Jan/Feb 2010 which I didn't fortunately have to incur for Jan/Feb 2011. Expenditures such as passport renewal, prepaying for tickets etc for our trip to Japan and Hong Kong, medical expenses. I got really gouged by medical expenses last year to the tune of $3,314 and wrote two post on medical bills:

* Navigating our health insurance

* Poor health can send you broke

Wednesday, January 12, 2011

Update on progress bars and interest income

It's only a few weeks away from Chinese New Year. I always look forward to it because mum always puts up a feast and I try to help her but I tend to start taste testing and munching too much *nom nom nom* to be of much help ;) This is a photo of the feast that she has cooked up last year:

Progress bars have been updated as of 12th January 2011

I've updated my progress bars. You can view the updated progress bars on my blog's right hand side column. Everything has been going along swimmingly. The savings for the IP is progressing slowly due to my bills inundating me over these past two months. My friend wants to go on our Europe trip mid-year so I may have to switch the saving goals and place the holiday as a priority ahead of the IP. I'm not sure I want to spend $12k on a trip anyway. Been there, done that, and it's been a lot of fun but then there are so many other competing things on the list to buy (see my wish list) and also to invest in. Holidays are a lot of fun, but because our holidays are so action packed, they are always so tiring!

Graph of my interest income for graph fanatics

For those of you who love graphs, here's a snapshot graph of my interest income. I like it when good things grow.... well, the interest income isn't significant yet but it's always exciting to see it increase because it means my money is working for me rather that I'm working for it. It's a source of passive income which is what I like.

It has been a very hectic month so far for 2011. In terms of returning from the Christmas and New Years holiday period and going back to work. A bunch of meetings already. I've also had to attend both, a wedding and very sadly a funeral, even though it has been barely two weeks into the New Year. Already experiencing such highs and lows.

Life can be really brief. Live life to the fullest and live each and every day as if they are special. Don't wait for tomorrow or wait for some day in the future because we never know our future and how long that we are on this earth for.

Wednesday, November 24, 2010

Asking for higher interest rates on my funds

Monday, October 26, 2009

Picking low hanging fruits first

A fruit tree or a tomato plant will ripen at the bottom first before the fruits at the top starts to ripen later. If you waited till the fruit at the top ripened, the lower ones will be picked by others to be enjoyed now and you've missed out.

This is just like investing. If you wait and wait for the right moment to invest or the right thing to invest in, you'll have missed the low hanging fruit in the wait for the fruits up high. Other investors will have pounced on the opportunity while you dither over your decision.

Sometimes, the waiting game pays off. That is, the fruit ripens, is perfect, clean and beautiful. Sometimes, the waiting game is a loss because that fruit that you were waiting for... the birds and the worms got to it first, or the weather wasn't ideal and the fruit rotted and fell off.

What's the solution?

You pick that low hanging fruit. And then you pick the fruit up the top when it ripens.

That's an analogy for investing.

You invest in those blue chip stocks with your funds, and when you learn and save up additional funds for investing further, you can dabble your extra funds with investments that are pie-in-the-sky type if you desire. Or you can plonk some funds into exploration firms or small capitalised firms. Those deemed to be riskier prospects.

The low hanging fruit, that is, the blue chips such as Coca Cola, Caterpillar, the banks (CBA, WBC, NAB), the mining royalties (BHP, RIO) and the retailers (David Jones, Woolworths, Wesfarmers) are examples of low hanging fruit. They're already ripe for the picking. They will provide you with a meal via their juicy dividends year after year unless they collapse.

The high hanging fruit such as the small capitalised firms and the exploration firms... they may eventually one day, ripen and provide you with something tasty such as dividends and massive capital gains, or on the other hand, there is also the possibility that they could rot before they ripen, becoming as sour as a lemon and cause you to cringe about how you could be so gullible, so naive, so silly and so crazy as to buy into a sucker stock.

Those elusively high hanging fruits are just that...a gamble. Leaving you hoping that with the perfect weather, they will all ripen up successfully. It's akin to you hoping, that with the right economic and trading conditions, those small caps and those explorations stocks, will also deliver something worthwhile.

If you pursue those high hanging fruits, don't forget to cover your bases so that you won't ever starve - pick some of those low hanging fruits first. Then you can make your move, buy some promising stocks that may or may not deliver.

Friday, October 23, 2009

Extreme Frugality Sucks

I've been reading hundreds of blogs lately. It's like my new addiction. I've noticed a few recurring themes now when it concerns financial blogs. The blogs with massive subscribers are either a) Informative, interesting and useful or b) Not so informative, but the blogger's story and background is dramatic and harrowing ... such as "This blog is about my journey in paying off my $159,000 debt."

The blogs that I choose to subscribe to would be the informative and interesting one. Is it really beneficial to read about someone who racked up over $100,000 in stupid credit card debt and heavy bouts of consumption binge? Sure, it's gripping and interesting, but you are really wasting your time unless you're in the same situation and trying to pay off the same silly consumption debt.

I have never had any consumption debt. Have never wanted to follow the crowd and buy a gazillion number of shoes and Louis Vuitton handbags. The sheer crowd of females in the city carrying LV bags proudly... there are so many of them that it's almost like an Louis Vuitton Brown Bag Army Brigade. I love good quality bags or shoes and pretty things just like any typical female but I just will not buy an LV Bag that will lump me into that category.

I have one credit card. If I need larger credit, I contact the bank to have the limit increased. It's so pointless to parade around with 5 or 15 credit cards. I have some investment debt. A positive net worth. A bit of student debt left to pay off which I don't choose to pay off with a lump sum payment because it's indexed to inflation and I can earn a better return elsewhere.

I hesitate at taking or reading financial advice from anyone and any blogger who has racked up consumption debt.

Would you consult an acoholic about how to quit drinking when they are still drinking heavily?

In order to progress and develop your skills in finance and investing, you need to take a good look inside yourself. You need to focus more on earning passive income than trying to learn how to be super frugal.

The bloggers with massive consumer debt, they will blog about selling things on ebay, craigslist, how to save money here and there and how to be so frugal that you live your life miserably. If you have debt, then yes, it's probably a good guidance for you.

But if you have savings and a positive net worth, your time is better spent reading websites and blogs where the bloggers have a positive net worth as well. That way you can learn more about how to invest, the type of assets you can invest in, how to calculate returns, the terminology and the financial geek speak etc.

But things like, never eating out, always cooking your own food from scratch, spending all your weekends cutting out coupons to save $3 or $5, growing your own vegetables, driving all over town to find discounts and bargains, signing up for 15 credit cards that have 0% introductory interest just so you can arbitrage and place it into a bank account and earn 3-4% interest and all those time consuming activities.

Is your time more valuable if you used it on productive matters such as starting your own business, improving your professional skills and working on increasing your income via a better paying job or improving your investing skills so that you can grow your passive income?

Extreme frugality is not the road to riches. It's the road to feeling miserable and cantankerous. Spend in moderation and focus on reading materials that will improve your business, professional or investment skills and you will discover what I've discovered... the bliss of earning income passively from investments and multiple income streams.