Robert Kiyosaki's book, 'Retire Young Retire Rich' makes a brash statement that it can teach you "How to get rich quickly and stay rich forever!"

This book is all about leveraging. The power of leveraging. Your mind is one of the most powerful form of leverage in the world and what you think and believe will influence how you make your decisions and take action. Laws of attraction.

How to leverage your mind, how to leverage your plans, how to leverage your actions and the leverage from taking that first step.

The three main assets that you can employ to enable you to retire young and retire rich are:

1. Real estate

2. Paper assets/stocks/shares

3. Businesses

Most of his books have repetitious sections and again, constantly spruik his own cash flow game and various other products. For the sake of this book analysis, I read everything.

Leveraging your mind

* Learn investment terminologies and words. The more financial words you learn, the greater your ability to invest and take advantage of various investments

* How did Kiyosaki get wealthy and successful? He writes that it was by increasing his:

a) Business skills

b) Money management skills

c) Investment skills

* Words that will work against you:

a) "But we don't have any money."

b) "I can't do that."

c) "I'll think about it next year, or once Kim and I get settled."

d) "You don't understand our situation."

e) "I need more time."

f) "Maybe someday when I have the money I'll begin to invest."

g) "Do you know how busy I am? I don't have the time to to learn to invest."

If you haven't got any funds to invest, then you can invest in your financial knowledge by taking the time to learn about investing in property, stocks and businesses. It costs nothing to acquire financial knowledge now that you can use the internet and you can always go the old school way and borrow books from the library. It's free to attend auctions, free to ask questions, free to attend open houses and free to analyse investment deals even if you haven't got the funds to invest. By the time you DO have some funds to invest, you will already be an investment pro to some extent because of the time that you've spent investing in your financial knowledge.

* "...the middle class and the poor fall behind the rich is because they use the financial power of bad debt to fall behind in life. The rich use the financial power of good debt to propel them ahead."

* Kiyosaki believes that his wealth resulted from the three asset classes mentioned (real estate, paper assets and business) and these were magnified by leveraging OPM (other people's money) and OPT (other people's time).

* Kiyosaki doesn't believe in someone being lucky simply by being at the right place at the right time. Luck happens only when you're "educated, experienced, ready and prepared to take advantage of the opportunity when the opportunity presented itself".

* The million dollar question that you can ask yourself. If you can answer this question, then you can create your own leverage into wealth: "How can I do what I do for more people with less work and for a better price?"

* "A person who thinks investing is risky will often find all the reality they want to substantiate that reality." Change your reality and your views in life by choosing to say, "How can I afford that piece of beachfront property?" instead of saying,"I can't afford it."

* Three form of income is mentioned:

a) Earned income - from your personal labour, your pay cheque, when you get pay rises, bonuses, overtime and commissions etc

b) Portfolio income - from your stock portfolio such as stocks, bonds, mutual/managed funds

c) Passive income- from real estate, royalties, patents and intellectual properties

* Earned income is disliked by Kiyosaki's 'rich dad' due to various reasons:

1. Highest taxed income with the fewest control over how much tax you pay and when you pay your taxes

2. You have to personally work for it using your valuable time

3. There's very little leverage in earned income and the primary way to increase earned income is by working harder

4. There is often no residual value for your work. If you don't work, you don't get paid.

* Again, Kiyosaki repeats himself from previous books:

a) Employee -> Earns, taxed, spends what is left

b) Business owner -> Earns, spends, pays tax on what is left

I'll use a simple example to illustrate this concept for you:

a) Employee with 30% tax -> Earns $100, is taxed $30, spends $20, is left with $50 in the pocket

b) Business with 30% tax-> Earns $100, spends $20, is taxed 30% on $80, is left with $56 in the pocket

* "The idea of working all your life, saving , and putting money into a retirement account is a very slow plan. It is a good and sensible plan for 90 percent of the people. But it is not a plan for someone who wants to retire young and retire rich. If you want to retire young and retire rich, you need to have a plan that is far faster than the plans of most people."

* "...you need to invest in what is going to happen, rather than what has already happened...If you want to see the future, you need to see it through younger eyes."

* "Over the years, we have attended many investment seminars, seminars on marketing, sales, systems development, handling employees and of course investing...I meet authors who did well in school as writers but their books do not sell as many as mine do. When I suggest to them that they attend direct marketing courses, or sales training courses, or copy writing classes, many get very indignant. As I said in Rich Dad Poor Dad, I am a best-selling author not a best-writing author."

* Calculate your wealth ratio. The goal is to have your passive and portfolio income exceed your total expenses so that even if you quit your 'earned income' job, you can still maintain your lifestyle. Once the ratio is 1 or higher, it's a choice whether you wish to quite the 'rat race' or not:

Wealth Ratio = Passive income + Portfolio income

Total expenses

Example: $600 passive + $200 portfolio = 0.2 wealth ratio

$4000 total expenses

* "When I think of the millions of people who are betting their financial future and their financial security on a stock market I cringe. Millions of people are worried about their financial future as the number of layoffs increase and the market continues to fluctuate....there are stories of how retirees have lost most of their retirement savings to investment advisers and insurance salespeople they trusted..."

* "Your life will change forever once you know the difference between saving money and making money."

* "The most life destroying word of all is the word tomorrow...the poor, the unsuccessful, the unhappy and the unhealthy are the ones who use the word tomorrow the most. These people will often say, 'I'll start investing tomorrow,' or 'I'll start my diet and exercise tomorrow.'"

* If you see an opportunity arise but were unable to take advantage of it, then "you are at the boundaries of your context, what you think is possible for yourself, and your content, which is the accumulated knowledge via which you handle problems and challenges..."

* Kiyosaki spends pages and pages writing about your reality, how people

don't realise that their reality is only limited by their mind. If you

don't expand your reality then you will never see the answers to your

problems because you are trying to solve your current problems with your

existing knowledge and experience: "Most people try and solve their financial problems with what they know, rather than expand what they know so they can solve a bigger problem. Rather than taking on bigger financial challenges, most people wrestle all their lives with financial problems they feel comfortable with."

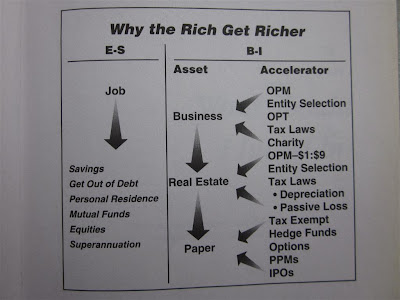

* In the book, 'Who took my money', you read about the E and S side of the quadrant and the B and I side of the quadrant. The goal is to move to the B-I side of the quadrant because income on the E-S side is limited whereas the earning potential from the B-I side is unlimited: "The trouble with selling your labour is that there is only so much you can do. If you learn to acquire or build assets to generate money, you can slowly but surely increase your income...your labour has no long term residual value. If you buy a rental property and you profitably rent it out, the labour you used to acquire that rental property can be rewarded over and over again, for years."

* "If you work slowly acquiring assets your income potential is infinite and that income can be passed on for generations to come. Your job or profession is not something you can pass on in your will to your children."

* "It is not your boss's job to make you rich. Your boss's job is to pay you for what you do, and it is your job to make yourself rich at home and in your spare time."

* "The moment you sincerely build a business or invest to increase your service to more people, you have forever increased your chances of becoming extremely wealthy and retiring young and retiring rich."

Leverage of habits that will make you rich

1. Hire a bookkeeper - having a bookkeeper keep your income, expenses, assets and liabilities in line so that you can keep professional records, have an unemotionally attached third party review your financial challenges so that you can make corrections via a monthly review of your financial situation

2. Create a winning team- the B+I quadrants are 'team sports' requiring team members such as your banker, accountant, attorney, stockbroker, real estate broker, insurance broker etc

3. Constantly expand your context and your content

4. Keep growing up- doing things differently as we grow older instead of doing the same old thing day in day out.

5. Be willing to fail more- by being willing to try new things and make mistakes

6. Listen to yourself- pay attention to what you are saying to yourself and focus on what you want from life and in your life

* "Kim(his wife) and I did not keep our money in a retirement account in order to retire young. We knew that we had to keep our money working, working hard to acquire more and more assets. Once our money acquired an asset, that money was soon reemployed to go out and get us another asset. The strategy we used to keep our money moving and acquiring more and more assets is a strategy that almost everyone can use."

* Comparing the stock market to the real estate market:

a) The stock market is simply buy or sell

b) The real estate market is negotiable- terms are negotiable, can lower or raise the price, can reduce expenses, can improve the value of the property by renovating such as painting, adding extra bedrooms, selling off extra land etc

* It does not take money to make money - Kiyosaki recommends people engage in option trading. I don't think I fully agree with his recommendation here because although you can write naked call and put options for a minor fee, if the naked options are being exercised by the holders of your put and call options, then you better HAVE the money to be able to buy the stocks off the put option holders or have the funds to buy the shares so that your call option holders can buy the stocks off you. So unless you wish to get into financial difficulty, it DOES take money to make money if you wish to pursue this particular strategy that Kiyosaki is proposing. Anyone trying to pursue this options trading strategy needs to ensure that they have backup funds that can be used to buy stocks off naked put option holders trying to exercise the put option that you sold them and similarly, have the funds to buy stocks that can be resold if holders of naked call options exercise their options.

I have to agree with Kiyosaki with respect to the statement that it doesn't take money to make money. You DON'T have to have money to make money. You can create money in so many ways even if you have zilch. If you are creative or have a great idea, you can sell your ideas. You have talent. You just need to capitalise on your talents, knowledge and abilities. You can create an intellectual property, you can create a blog (like this) from scratch for free and generate advertisement income from Google Adwords and from advertisers wishing to advertise with your blog/website. I created this site from scratch and it didn't cost me a single cent and it's been generating income for me. That's just one example. Obviously the more money you have, the easier it is to buy and create investments and the faster you make more money.

But work with what you've got. If you've got nothing, you can create something from nothing. The sky really is your limit. There is over 6 billion people on this planet and what is stopping you from generating a chunk of revenue from that population?

What would you do if there was no risk and it required no money to become rich?

Kiyosaki challenges us to think about what we would do if there was no risk and no money required to become rich. What type of business or investment or hobby would you start? What trade would you be in? Would you retire? Do you think that type of world exists? If you think that world is non existent, do you think you are destroying yourself by limiting your creativity?

In closing, Kiyosaki writes that "Leverage is power. Leverage is found inside of us, all around us, and invented by us. With each new invention, inventions such as the automobile, airplane, telephone, television, world wide web, a new form of leverage is invented. With each new form of leverage, new millionaires and billionaires are created because they used the leverage, not ruined or abused the new leverage. So always remember that the power of leverage can be used, abused or feared. How you choose to use the power of leverage is up to you and only you."

Tuesday, December 18, 2012

Saturday, December 15, 2012

Robert Kiyosaki: Who Took My Money?

Book review on Robert Kiyosaki: Who Took My Money?

Robert Kiyosaki's book(co-authored with Sharon L. Lechter), 'Who Took My Money?' on "Why slow investors lose and fast money wins" is an interesting read. If you've never heard of Kiyosaki, then you've been living under a rock. He's been on the New York Times Bestseller list multiple times with multiple books.

Although 'Rich Dad Poor Dad' is his most famous book, it's not a favourite of mine. His later books are much better because he becomes a more experienced investor with a better advisory team when he has more money to invest and it's evident in the later books compared to his earlier work. Kiyosaki's book can be annoying to read sometimes because he keeps plugging his own products and boardgame, almost in every single chapter :/

Are Mutual Funds and Managed Funds evil?

Kiyosaki thoroughly dislikes Mutual Funds (for Australian readers, Mutual Funds=Managed Funds, 401(k)=Retirement Funds). He's always denouncing them and telling readers to steer clear of them. I'm not a huge fan of managed funds either. Some are decent (like the index funds with low fees) but the majority has high fees, does not outperform the index (eg All Ords, ASX200) and will charge you fees even if they are losing money hands over fist.

I'm going to highlight the bits that I found interesting or may be of interest to anyone else. 'Who Took My Money'(WTMM) was first published in May 2004, prior to the GFC and mainly reflects on the dotcom sharemarket bust. Ironically, his book is timelessly relevant in light of the GFC crisis that rocked the world in 2008.

WTMM is structured into two sections: "What Should I Invest In?" and "Ask An Investor".

What Should You Invest In?

Kiyosaki doesn't like diversification in simply the stock market. He recommends 'integrating' and using the powers of the following 'financial forces':

1. Business

2. Real estate

3. Paper assets (shares/stocks)

4. Your banker's money (via leveraging/gearing/mortgage loans/margin loans)

5. Tax laws (via depreciation and the ability to deduct expenses prior to paying tax on profits)

6. Corporate laws (via business entity, copyrights, patents etc)

Whereby, the more you can mix and match those particular 'forces', the more you can accelerate your wealth and returns to create 'financial synergy'.

He refers to life as 'The Game of Money' because we work for approximately 40 years. When you're 25-35yo, you're in the first quarter, 35-45 is second quarter, 45-55 is third quarter and 55-65 is the fourth quarter. After 65, you're in overtime and if you're disabled or have some health impediment, then you're 'out of time'.

Kiyosaki refers to a cash flow quadrant whereby he recommends moving from the 'employee' and 'self employed' side to the 'business owner' and 'investor' side of the quadrants will accelerate your returns. See below:

Employees and self employed individuals will only earn income whilst their personal labour is involved. If you don't work, you don't earn. Simple. On the business owner and investor side, if you don't work, your business and your investments will still generate passive income for you.

The reason why B-I are will help you get richer faster is due to reasons such as utilising OPM(other people's money), choice of operating entity, ability to depreciate your assets against your returns (he refers to depreciation as 'phantom income') and the ability to leverage. Just as the financial institutions use leveraging(on bank deposits) to magnify their returns, you can also use leveraging(from bank/mortgage loans) to magnify your own returns. Savers and depositors earn peanuts on their savings.

The most important aspect of the B-I side which I would also like to emphasise is that you can deduct your expenses against your income prior to paying tax as a business owner and investor. Unfortunately for employees, usually you pay tax first prior to being able to deduct your expenses.

Kiyosaki rather dislikes answering the question, "I have $10k, what should I invest in?". It's a difficult and complex question to answer. Firstly, it depends on your own scenario, how old you are, where you're at in life, what existing debts you have already and where you're at in terms of financial knowledge and experience. If you don't know what to do with your $10k, then the best thing you should do is stash it in a high interest savings account. Go read about investing and then you will have a better idea of what to do with it. Otherwise, you will eventually get fleeced.

He writes that simply putting all your savings into a 'mutual fund/managed fund', dollar cost averaging by monthly contributions, crossing your fingers and praying that the stock market goes up is akin to gambling. There are no guarantees that you won't lose money, there are no insurance company that will insure your stock portfolio against losses. You can insure your stock portfolio but you will need to employ put and call options which are techniques that most average and newbie investors are unable to employ.

He contrasts this against buying investment properties. Insurance companies will insure investment properties because it's a more stable investment but they won't insure your stock portfolio. Using these two examples, he illustrates that the stock market IS riskier than the property market.

"One of the reasons so many investors lose so much money is because they pay $10 a month into a fund for forty years and do not know if it will be there forty years from now."

Maybe Kiyosaki was on the foreclosure ball already back in 2004 when he wrote that, "Today in Phoenix, Arizona, the fastest growing major market in America, foreclosures are up. Many people are losing their homes. Investors are bailing out of properites that they paid too much for."

Unfortunately he was wrong thus far on the Australian property market, "In Australia, interest rates are on the rise again, which will mean the greater fools of the property market will be led to slaughter." Property prices have risen significantly since 2004.

Building pipelines

I once read a quote from Napoleon about investing. He said that investing is like planting trees(or was it fruit trees?). It takes many years, but after several decades, you will have a forest to protect and feed you. I like thinking about investing as planting young fruit trees. The more fruit trees planted and the earlier you plant them, the more fruit you will get as they mature over the years and you will beable to enjoy a whole forest and orchard of trees.

Kiyosaki compares investing to building pipelines. Over the years, you wish to expand the diameter of your pipelines. The goal is to "simply build the pipelines and continuously expand the diameter of the pipe" which is a metafore for increasing the amount of passive income and return that flows from your investment. When you first start, it's a drip and over time as you expand your business and or investments, it becomes a heavier flow of passive income.

This post is becoming insanely long so I'll just quote directly from the book without any of my own personal reflections:

* "one of the most important assets an investor needs to manage is their flow of information. One of the reasons many millions of investors lost trillions of dollars is because they received financial information that was of poor quality, late, often biased, and sometimes dishonest."

* "Waiting for the long term...millions of investors, even while losing a lot of money in the stock market, are still waiting for the market and the price of their shares to come back up. That is a waste of time. Although the market will someday be back, the market that they lost their money in is gone...instead of investing for the long term, they are waiting for the long term..."

* "The professional investor follows the following formula:

1. Invest money into an asset

2. Get the original investment money back

3. But keep control of the original asset

4. Move the money into a new asset

5. Get the investment money back

6. Repeat the process ...this process is called the velocity of money...most investors do not realise they too can expand their own money supply and thereby expand their earning power"

* "Consider control and how it differs among the different type of asset classes...

Owning your own business - You are in control

Owning real estate - You are in control

401(k)s /retirement funds - Who is in control?

Mutual funds/managed funds - Who is in control?

Equities/stocks - Who is in control?

... The individual companies have presidents and board of directors who have control over the operation of the underlying business...professional investors want CONTROL over their assets and their cash flow." The ability to control means you can determine how to reduce expenses, how to increase income, when to pay tax (ie when to sell and trigger CGT tax) and your leveraging ability.

* "Many people just turn their money over to total strangers and wonder why they get such poor returns. Or many people seem to think that it should be easy to find a great investment...The fact is, it's easy to find bad investments. The world is filled with people offering you bad investments to invest in. If you want your money to work hard for you, you cannot afford to be lazy."

* "Four green houses...one red hotel...the purpose of business is to make life simpler, not harder. The businesses that make life the easiest are the businesses that make the most money." He employs examples such as cars, phones, supermarket, electric companies etc

* "You should learn to take things that are difficult and make them simple. If you will focus on that, making life easier for people, you will become a very rich person. The more people you help in making life easier, the richer you will become."

* "The power of power investing...it is investing using all three asset classes(business, real estate and paper assets), reinvesting cash flow, leveraged with OPM and accelerated by tax incentives...power investing requires that the investor invest in two, and preferably three, asset classes."

* "...why then do so many more people invest in paper assets and give up so much control? ...the answer...found in the word easy. For millions of people, it is easier to turn over control of their money than to learn how to drive their money. That is why millions of investors have their portfolios filled with mutual funds without any idea of who is driving the fund..."

* Kiyosaki likes paper assets primarily due to their liquidity rather than their long term value. I agree absolutely.

* An employee's cash flow pattern: EARN-->PAY TAX-->THEN SPEND

* A business owner or investor cash flow pattern: EARN-->SPEND--THEN PAY TAX

* "...the five considerations for each investment and how the investment fits into your overall investing strategy:

1. Earn/create- how will it generate cash flow for you?

2. Manage- how will you manage this investment?

3. Leverage- how much leverage will the investment provide, or can you get?

4. Protect- how should you hold the investment, maximise its profitability and protect it from potential creditors?

5. Exit- how will you get your original investment money back?"

That last quote from the book is imo, one of the MOST important part of the investing process. Answering those five points prior to investing will mean you've looked at all the aspects of the cash flow, the potential benefits, protecting your asset and finally, being able to extract your capital so that you can invest in additional assets.

Investing for cash flow is a VERY important concept. If you only invest for capital gains and employ negative gearing as your dominant investment strategy, eventually you will hit a debt servicing capacity wall and be unable to service further investment leveraging due to poor cash flow.

It's been a long time since I've written a book review and now I remember why I don't post book reviews often lol. PHEW!! It has been over two years since I've published material regarding personal finance books. The last one I wrote two years ago, 'Top 10 Books on Wealth' is STILL relevant because they're classic books. You should read that post if you like reading personal financial management books.

Robert Kiyosaki's book(co-authored with Sharon L. Lechter), 'Who Took My Money?' on "Why slow investors lose and fast money wins" is an interesting read. If you've never heard of Kiyosaki, then you've been living under a rock. He's been on the New York Times Bestseller list multiple times with multiple books.

Although 'Rich Dad Poor Dad' is his most famous book, it's not a favourite of mine. His later books are much better because he becomes a more experienced investor with a better advisory team when he has more money to invest and it's evident in the later books compared to his earlier work. Kiyosaki's book can be annoying to read sometimes because he keeps plugging his own products and boardgame, almost in every single chapter :/

Are Mutual Funds and Managed Funds evil?

Kiyosaki thoroughly dislikes Mutual Funds (for Australian readers, Mutual Funds=Managed Funds, 401(k)=Retirement Funds). He's always denouncing them and telling readers to steer clear of them. I'm not a huge fan of managed funds either. Some are decent (like the index funds with low fees) but the majority has high fees, does not outperform the index (eg All Ords, ASX200) and will charge you fees even if they are losing money hands over fist.

I'm going to highlight the bits that I found interesting or may be of interest to anyone else. 'Who Took My Money'(WTMM) was first published in May 2004, prior to the GFC and mainly reflects on the dotcom sharemarket bust. Ironically, his book is timelessly relevant in light of the GFC crisis that rocked the world in 2008.

WTMM is structured into two sections: "What Should I Invest In?" and "Ask An Investor".

What Should You Invest In?

Kiyosaki doesn't like diversification in simply the stock market. He recommends 'integrating' and using the powers of the following 'financial forces':

1. Business

2. Real estate

3. Paper assets (shares/stocks)

4. Your banker's money (via leveraging/gearing/mortgage loans/margin loans)

5. Tax laws (via depreciation and the ability to deduct expenses prior to paying tax on profits)

6. Corporate laws (via business entity, copyrights, patents etc)

Whereby, the more you can mix and match those particular 'forces', the more you can accelerate your wealth and returns to create 'financial synergy'.

He refers to life as 'The Game of Money' because we work for approximately 40 years. When you're 25-35yo, you're in the first quarter, 35-45 is second quarter, 45-55 is third quarter and 55-65 is the fourth quarter. After 65, you're in overtime and if you're disabled or have some health impediment, then you're 'out of time'.

Kiyosaki refers to a cash flow quadrant whereby he recommends moving from the 'employee' and 'self employed' side to the 'business owner' and 'investor' side of the quadrants will accelerate your returns. See below:

Employees and self employed individuals will only earn income whilst their personal labour is involved. If you don't work, you don't earn. Simple. On the business owner and investor side, if you don't work, your business and your investments will still generate passive income for you.

The reason why B-I are will help you get richer faster is due to reasons such as utilising OPM(other people's money), choice of operating entity, ability to depreciate your assets against your returns (he refers to depreciation as 'phantom income') and the ability to leverage. Just as the financial institutions use leveraging(on bank deposits) to magnify their returns, you can also use leveraging(from bank/mortgage loans) to magnify your own returns. Savers and depositors earn peanuts on their savings.

The most important aspect of the B-I side which I would also like to emphasise is that you can deduct your expenses against your income prior to paying tax as a business owner and investor. Unfortunately for employees, usually you pay tax first prior to being able to deduct your expenses.

Kiyosaki rather dislikes answering the question, "I have $10k, what should I invest in?". It's a difficult and complex question to answer. Firstly, it depends on your own scenario, how old you are, where you're at in life, what existing debts you have already and where you're at in terms of financial knowledge and experience. If you don't know what to do with your $10k, then the best thing you should do is stash it in a high interest savings account. Go read about investing and then you will have a better idea of what to do with it. Otherwise, you will eventually get fleeced.

He writes that simply putting all your savings into a 'mutual fund/managed fund', dollar cost averaging by monthly contributions, crossing your fingers and praying that the stock market goes up is akin to gambling. There are no guarantees that you won't lose money, there are no insurance company that will insure your stock portfolio against losses. You can insure your stock portfolio but you will need to employ put and call options which are techniques that most average and newbie investors are unable to employ.

He contrasts this against buying investment properties. Insurance companies will insure investment properties because it's a more stable investment but they won't insure your stock portfolio. Using these two examples, he illustrates that the stock market IS riskier than the property market.

"One of the reasons so many investors lose so much money is because they pay $10 a month into a fund for forty years and do not know if it will be there forty years from now."

Maybe Kiyosaki was on the foreclosure ball already back in 2004 when he wrote that, "Today in Phoenix, Arizona, the fastest growing major market in America, foreclosures are up. Many people are losing their homes. Investors are bailing out of properites that they paid too much for."

Unfortunately he was wrong thus far on the Australian property market, "In Australia, interest rates are on the rise again, which will mean the greater fools of the property market will be led to slaughter." Property prices have risen significantly since 2004.

Building pipelines

I once read a quote from Napoleon about investing. He said that investing is like planting trees(or was it fruit trees?). It takes many years, but after several decades, you will have a forest to protect and feed you. I like thinking about investing as planting young fruit trees. The more fruit trees planted and the earlier you plant them, the more fruit you will get as they mature over the years and you will beable to enjoy a whole forest and orchard of trees.

Kiyosaki compares investing to building pipelines. Over the years, you wish to expand the diameter of your pipelines. The goal is to "simply build the pipelines and continuously expand the diameter of the pipe" which is a metafore for increasing the amount of passive income and return that flows from your investment. When you first start, it's a drip and over time as you expand your business and or investments, it becomes a heavier flow of passive income.

This post is becoming insanely long so I'll just quote directly from the book without any of my own personal reflections:

* "one of the most important assets an investor needs to manage is their flow of information. One of the reasons many millions of investors lost trillions of dollars is because they received financial information that was of poor quality, late, often biased, and sometimes dishonest."

* "Waiting for the long term...millions of investors, even while losing a lot of money in the stock market, are still waiting for the market and the price of their shares to come back up. That is a waste of time. Although the market will someday be back, the market that they lost their money in is gone...instead of investing for the long term, they are waiting for the long term..."

* "The professional investor follows the following formula:

1. Invest money into an asset

2. Get the original investment money back

3. But keep control of the original asset

4. Move the money into a new asset

5. Get the investment money back

6. Repeat the process ...this process is called the velocity of money...most investors do not realise they too can expand their own money supply and thereby expand their earning power"

* "Consider control and how it differs among the different type of asset classes...

Owning your own business - You are in control

Owning real estate - You are in control

401(k)s /retirement funds - Who is in control?

Mutual funds/managed funds - Who is in control?

Equities/stocks - Who is in control?

... The individual companies have presidents and board of directors who have control over the operation of the underlying business...professional investors want CONTROL over their assets and their cash flow." The ability to control means you can determine how to reduce expenses, how to increase income, when to pay tax (ie when to sell and trigger CGT tax) and your leveraging ability.

* "Many people just turn their money over to total strangers and wonder why they get such poor returns. Or many people seem to think that it should be easy to find a great investment...The fact is, it's easy to find bad investments. The world is filled with people offering you bad investments to invest in. If you want your money to work hard for you, you cannot afford to be lazy."

* "Four green houses...one red hotel...the purpose of business is to make life simpler, not harder. The businesses that make life the easiest are the businesses that make the most money." He employs examples such as cars, phones, supermarket, electric companies etc

* "You should learn to take things that are difficult and make them simple. If you will focus on that, making life easier for people, you will become a very rich person. The more people you help in making life easier, the richer you will become."

* "The power of power investing...it is investing using all three asset classes(business, real estate and paper assets), reinvesting cash flow, leveraged with OPM and accelerated by tax incentives...power investing requires that the investor invest in two, and preferably three, asset classes."

* "...why then do so many more people invest in paper assets and give up so much control? ...the answer...found in the word easy. For millions of people, it is easier to turn over control of their money than to learn how to drive their money. That is why millions of investors have their portfolios filled with mutual funds without any idea of who is driving the fund..."

* Kiyosaki likes paper assets primarily due to their liquidity rather than their long term value. I agree absolutely.

* An employee's cash flow pattern: EARN-->PAY TAX-->THEN SPEND

* A business owner or investor cash flow pattern: EARN-->SPEND--THEN PAY TAX

* "...the five considerations for each investment and how the investment fits into your overall investing strategy:

1. Earn/create- how will it generate cash flow for you?

2. Manage- how will you manage this investment?

3. Leverage- how much leverage will the investment provide, or can you get?

4. Protect- how should you hold the investment, maximise its profitability and protect it from potential creditors?

5. Exit- how will you get your original investment money back?"

That last quote from the book is imo, one of the MOST important part of the investing process. Answering those five points prior to investing will mean you've looked at all the aspects of the cash flow, the potential benefits, protecting your asset and finally, being able to extract your capital so that you can invest in additional assets.

Investing for cash flow is a VERY important concept. If you only invest for capital gains and employ negative gearing as your dominant investment strategy, eventually you will hit a debt servicing capacity wall and be unable to service further investment leveraging due to poor cash flow.

It's been a long time since I've written a book review and now I remember why I don't post book reviews often lol. PHEW!! It has been over two years since I've published material regarding personal finance books. The last one I wrote two years ago, 'Top 10 Books on Wealth' is STILL relevant because they're classic books. You should read that post if you like reading personal financial management books.

Thursday, December 6, 2012

Gaining Traction In The Australian PF Blog Market

Due to blog traffic increasing, this has resulted in SMG gaining traction in the personal finance market in Australia. What has been happening?

I've had a few proposals from companies wanting to offer affiliate products and offering to pay commissions via affiliate product sales (so far I'm not interested). Companies wanting to pay me to publish their articles and companies wanting my blog to give them links out using particular anchor text.

I also get plenty of requests wanting free plugs, guest posting etc but so far that doesn't really interest me either.

The latest queries wishing to form some type of relationship has been from Australian based marketing firms on behalf of their clients. I don't know whether I should take the leap and venture deeper into paid territory because that may possibly influence me into publishing something that I may not morally agree with nor believe will be beneficial for readers.

Never thought I'd reach a blogging point where there would be sufficient visits to this blog to garner interest from marketing firms. It's been very interesting...

If I had started a food blog then I would have happily leaped into offers to dine and sample new cuisines without a single thought lol ...but because I write primarily about personal finance and money, I have to be more diligent and careful that I don't mislead you by promoting financial products and or sites that are detrimental to your finances.

I've had a few proposals from companies wanting to offer affiliate products and offering to pay commissions via affiliate product sales (so far I'm not interested). Companies wanting to pay me to publish their articles and companies wanting my blog to give them links out using particular anchor text.

I also get plenty of requests wanting free plugs, guest posting etc but so far that doesn't really interest me either.

The latest queries wishing to form some type of relationship has been from Australian based marketing firms on behalf of their clients. I don't know whether I should take the leap and venture deeper into paid territory because that may possibly influence me into publishing something that I may not morally agree with nor believe will be beneficial for readers.

Never thought I'd reach a blogging point where there would be sufficient visits to this blog to garner interest from marketing firms. It's been very interesting...

If I had started a food blog then I would have happily leaped into offers to dine and sample new cuisines without a single thought lol ...but because I write primarily about personal finance and money, I have to be more diligent and careful that I don't mislead you by promoting financial products and or sites that are detrimental to your finances.

Subscribe to:

Comments (Atom)